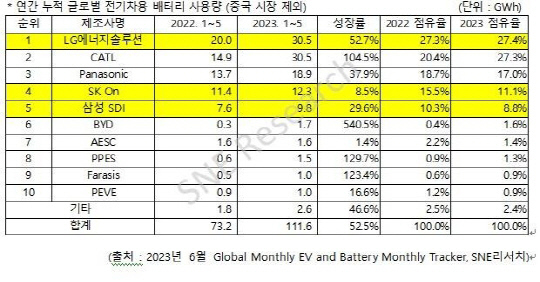

LG Energy Solution has narrowly maintained its position as the top player in the global electric vehicle (EV) battery market, excluding China, this year from January to May. However, China's CATL has been closely catching up with LG Energy Solution as battery usage has surged.

According to market research firm SNE Research on the 7th, the battery usage in EVs sold worldwide, excluding China, during January to May this year amounted to approximately 111.6 GWh, a 52.5% increase compared to the same period last year.

Among the companies, LG Energy Solution took the lead with a battery usage of 30.54 GWh, a 52.7% increase from the same period last year.

CATL also showed remarkable growth in non-Chinese markets. The company's battery usage reached 30.51 GWh, a 104.5% increase from the same period last year.

In terms of market share, LG Energy Solution recorded 27.4%, while CATL followed closely with 27.3%. The gap between the two companies, which was 6.9 percentage points last year, narrowed down to 0.1 percentage points.

Japanese company Panasonic maintained its third-place position with 18.9 GWh, a 37.9% increase from the same period last year.

Korean companies SK Innovation and Samsung SDI secured the fourth and fifth spots, respectively. SK Innovation's battery usage increased by 8.5% to 12.3 GWh compared to the same period last year, while Samsung SDI reached 9.8 GWh, a 29.6% increase.

The market share of the three Korean companies recorded 47.3%, a 5.8 percentage point decrease from the same period last year. LG Energy Solution's market share slightly increased from 27.3% to 27.4%. SK Innovation decreased from 15.5% to 11.1%, and Samsung SDI dropped from 10.3% to 8.8%.

A representative from SNE Research stated, "LG Energy Solution maintains its top position in non-Chinese markets, but CATL's high growth poses a threat to its first-place position." They also mentioned that Chinese companies are expected to enter the overseas market beyond the domestic market, which is currently facing oversupply. Additionally, Chinese companies are likely to target the international market, focusing on lithium, phosphate, and iron (LFP) batteries in line with the pricing differentiation strategies of major automakers. The usage of LFP batteries and the market share changes of Chinese companies are particularly noteworthy in low LFP battery adoption regions such as Europe.

https://n.news.naver.com/mnews/article/029/0002811918?sid=101